GLOBAL SPONSOR, STRONG PIPELINE

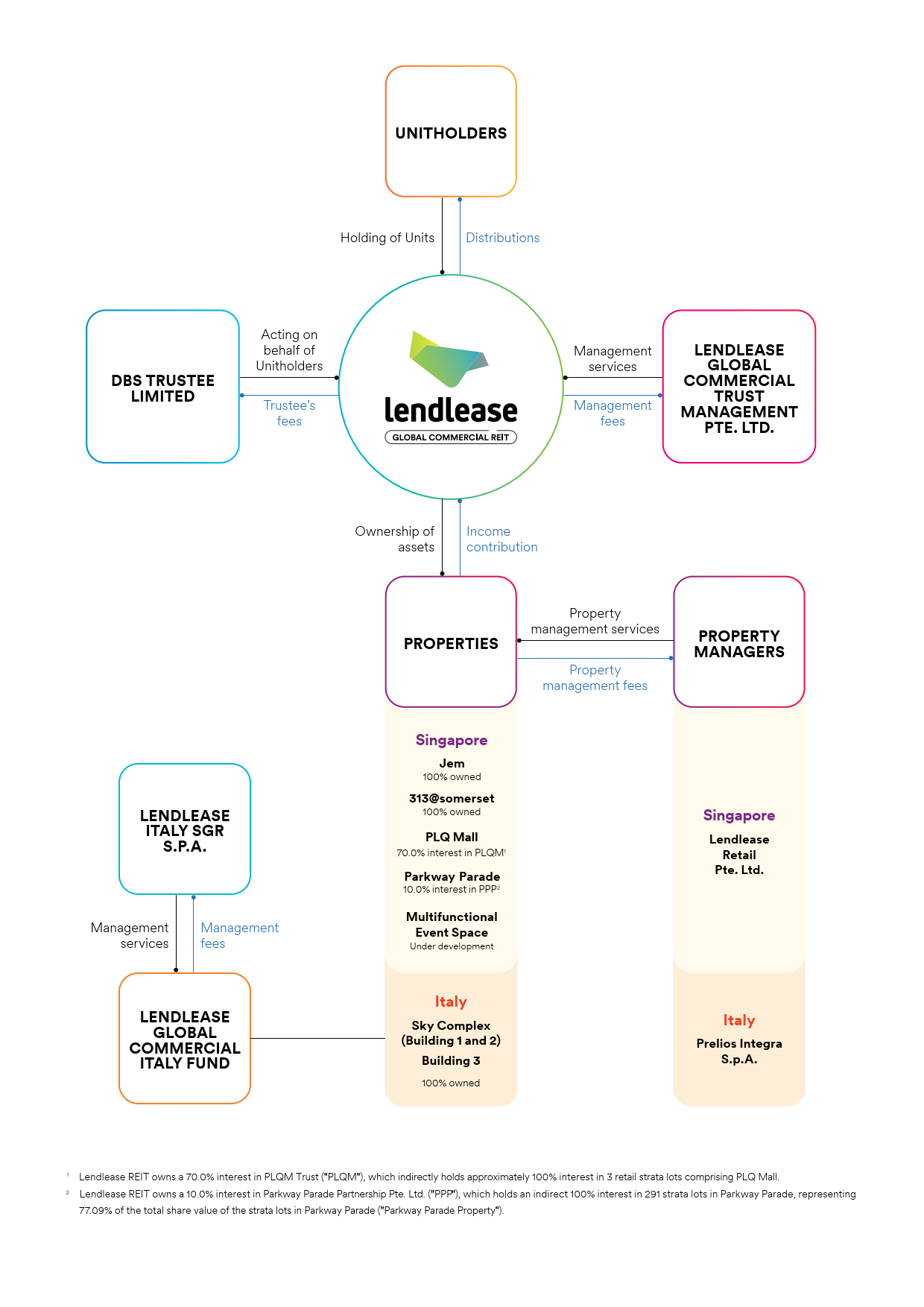

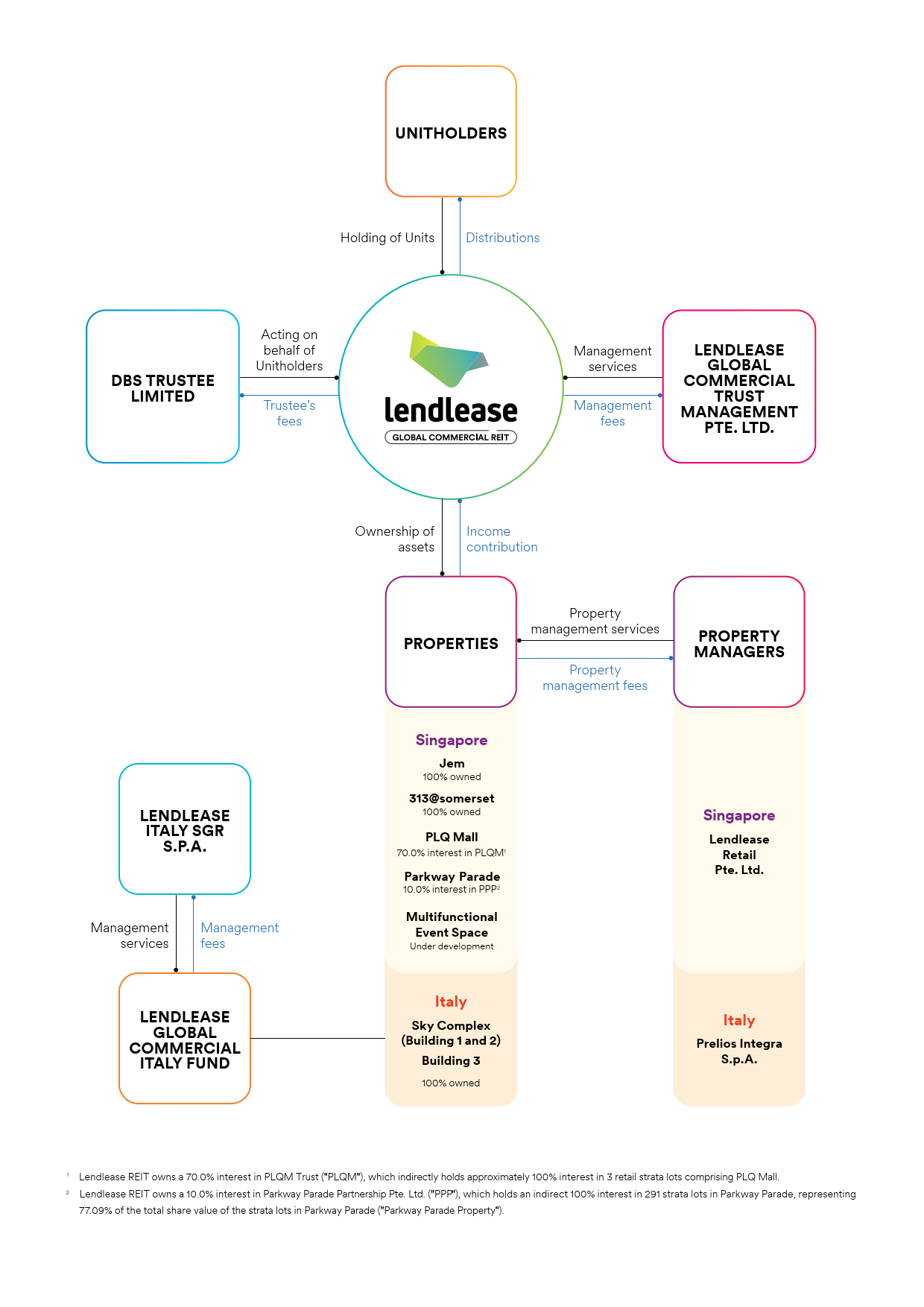

Listed on 2 October 2019, Lendlease Global Commercial REIT (“Lendlease REIT”) is a Singapore real estate investment trust established with the principal investment strategy of investing, directly or indirectly, in a diversified portfolio of stabilised income-producing real estate assets1 located globally, which are used primarily for retail and/or office purposes.

Its portfolio comprises leasehold interest in three Singapore retail properties: Jem, 313@somerset, and a 70% interest in PLQ Mall. It also holds freehold interest in three Grade A commercial buildings in Milan. Other investments include a stake in Parkway Parade and the development of a multifunctional event space on a site adjacent to 313@somerset.

Lendlease REIT is managed by Lendlease Global Commercial Trust Management Pte. Ltd. (the “Manager”), an indirect wholly-owned subsidiary of the Sponsor.

The Sponsor, Lendlease Corporation Limited, is part of the Lendlease Group2 . Lendlease is a market-leading Australian real estate group. Headquartered in Sydney, Lendlease is listed on the Australian Securities Exchange. Its core capabilities are reflected in its operating segments of Investments, Development and Construction. The combination of these three segments provides a sustainable competitive advantage in delivering innovative solutions for its customers.

-

THE MISSION

Lendlease Global Commercial REIT’s key objectives are:

(i) Provide Unitholders with regular and stable distributions

(ii) Achieve long-term growth in distribution per unit and Net Asset Value per unit

(iii) Maintain an optimal capital structure -

TRUST & ORGANISATION STRUCTURE

Lendlease Global Commercial REIT’s key objectives are:

(i) Provide Unitholders with regular and stable distributions

(ii) Achieve long-term growth in distribution per unit and Net Asset Value per unit

(iii) Maintain an optimal capital structure

1 “A stabilised income-producing real estate asset” means a real estate asset which meets the following criteria as at the date of the proposed offer: (i) achieved a minimum occupancy of at least 80%; (ii) achieved an average rental rate comparable to the market rental rate for similar assets as determined by the valuer commissioned for the latest valuation of the relevant asset; (iii) (if the asset is being acquired from the Lendlease Group) Lendlease REIT being satisfied that there are no material asset enhancement initiatives required within two years of the acquisition of such asset; and (iv) is suitable for acquisition by Lendlease REIT taking into account market conditions at the time of the proposed offer.

2 Lendlease Group comprises the Sponsor, Lendlease Trust and their subsidiaries.