GLOBAL SPONSOR, STRONG PIPELINE

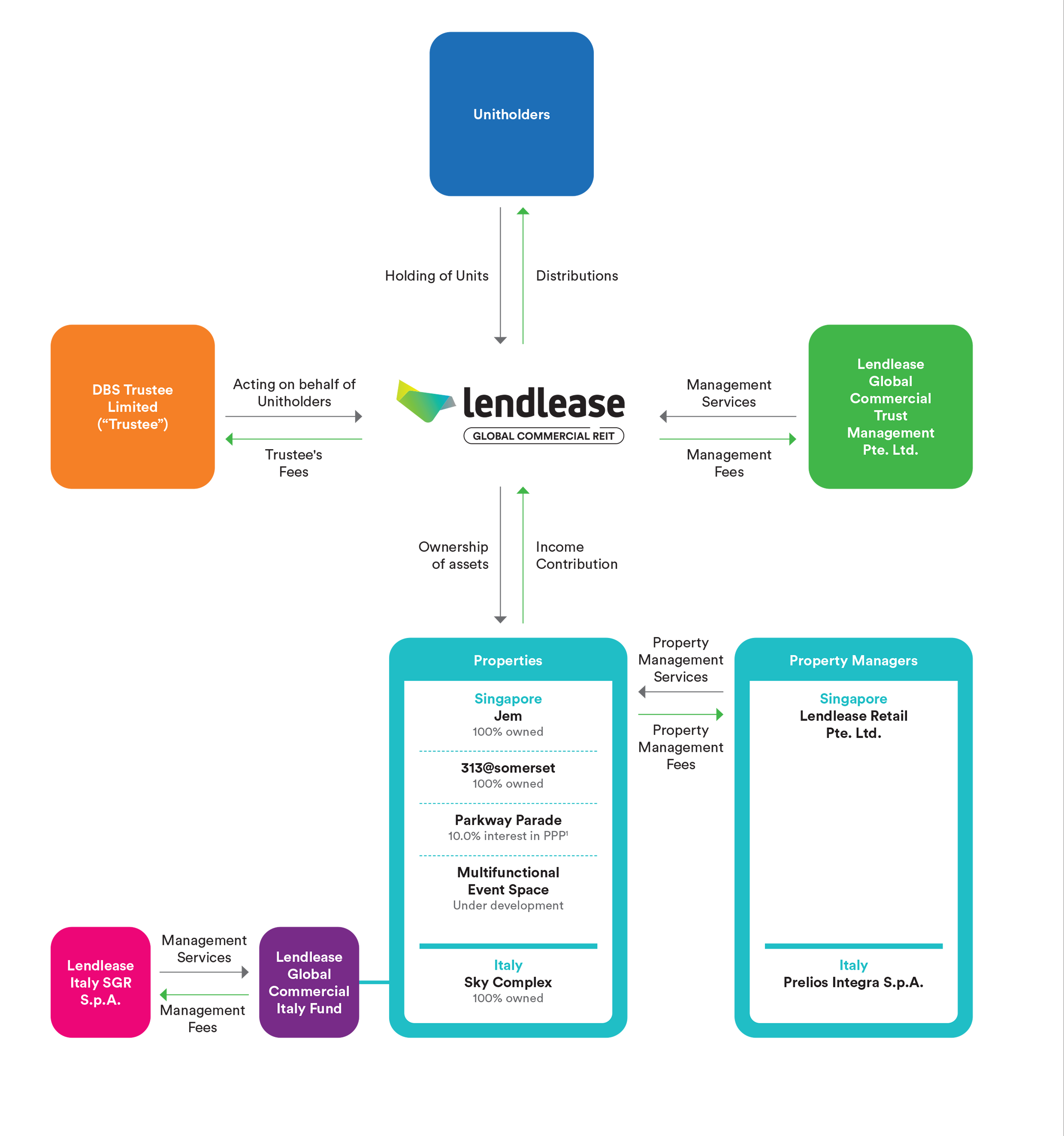

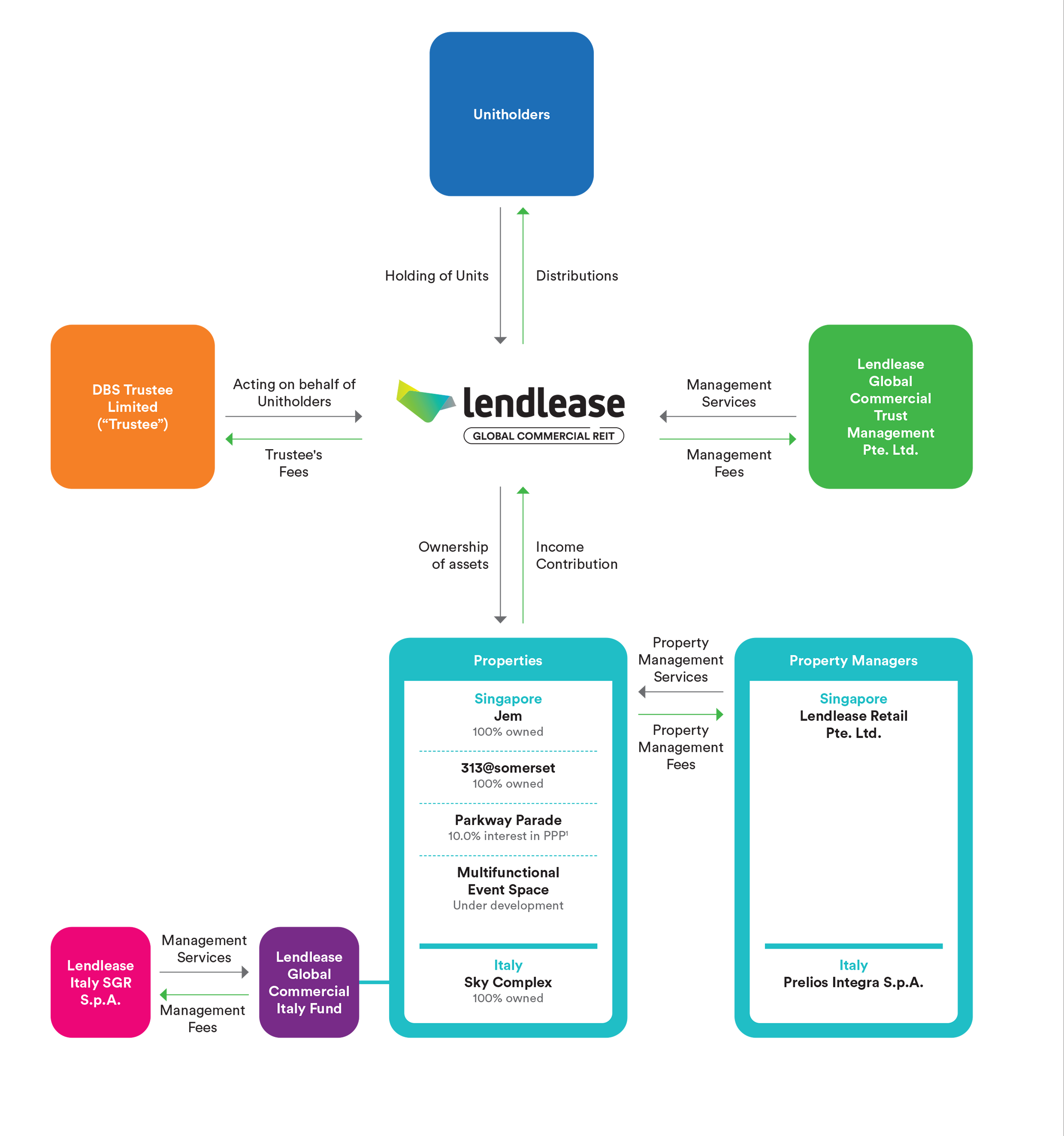

Listed on 2 October 2019, Lendlease Global Commercial REIT (“LREIT”) is a Singapore real estate investment trust established with the principal investment strategy of investing, directly or indirectly, in a diversified portfolio of stabilised income-producing real estate assets1 located globally, which are used primarily for retail and/or office purposes.

Its portfolio comprises leasehold interest in two properties in Singapore namely Jem (office and retail property) and 313@somerset (retail property) as well as freehold interest in three Grade A commercial buildings, Sky Complex, in Milan. Other investments include a stake in Parkway Parade and development of a multifunctional event space on a site adjacent to 313@somerset.

LREIT is managed by Lendlease Global Commercial Trust Management Pte. Ltd. (the “Manager”), an indirect wholly-owned subsidiary of the Sponsor.

-

THE MISSION

Lendlease Global Commercial REIT’s key objectives are:

(i) Provide Unitholders with regular and stable distributions

(ii) Achieve long-term growth in distribution per unit and Net Asset Value per unit

(iii) Maintain an optimal capital structure -

TRUST & ORGANISATION STRUCTURE

1 LREIT owns a 10.0% interest in Parkway Parade Partnership Pte. Ltd. ("PPP"), which holds an indirect 100% interest in 291 strata lots in Parkway Parade, representing 77.09% of the total share value of the strata lots in Parkway Parade ("Parkway Parade Property")

Lendlease Global Commercial REIT’s key objectives are:

(i) Provide Unitholders with regular and stable distributions

(ii) Achieve long-term growth in distribution per unit and Net Asset Value per unit

(iii) Maintain an optimal capital structure

1 LREIT owns a 10.0% interest in Parkway Parade Partnership Pte. Ltd. ("PPP"), which holds an indirect 100% interest in 291 strata lots in Parkway Parade, representing 77.09% of the total share value of the strata lots in Parkway Parade ("Parkway Parade Property")

1 “A stabilised income-producing real estate asset” means a real estate asset which meets the following criteria as at the date of the proposed offer: (i) achieved a minimum occupancy of at least 80%; (ii) achieved an average rental rate comparable to the market rental rate for similar assets as determined by the valuer commissioned for the latest valuation of the relevant asset; (iii) (if the asset is being acquired from the Lendlease Group) LREIT being satisfied that there are no material asset enhancement initiatives required within two years of the acquisition of such asset; and (iv) is suitable for acquisition by LREIT taking into account market conditions at the time of the proposed offer.