SUSTAINABILITY

LREIT has established an Environmental, Social, Governance (“ESG”) Committee under the Board of Directors.

The ESG Committee, chaired by Mr Simon John Perrott (Independent Non-Executive Director), consists of three board members, Dr Tsui Kai Chong (Lead Independent Non-Executive Director), Mrs Lee Ai Ming (Independent Non-Executive Director) and Ms Penelope Jane Ransom (Non-Independent Non-Executive Director).

LREIT aims to deliver a sustainable future for its stakeholders by striving towards economic, social and environmental progress. As a signatory to the UN GC, the Manager is committed to deliver inclusive, healthy and adaptable places that can thrive through change.

LREIT undertakes ESG under the Group’s four guiding principles – Safety, Sustainability, Diversity and Inclusion and Customer Focus. In line with the Group’s signatory commitment under the UN supported Principles for Responsible Investment, the Manager is committed to creating value for LREIT’s stakeholders by delivering positive economic, environmental and social outcomes whilst operating in an incident and injury free environment.

LREIT has received the highest rating of 5 Star from the GRESB, a global ESG evaluation agency, for four consecutive years since 2019.

ANOTHER YEAR OF OUTSTANDING RESULT IN 2024 GRESB REAL ESTATE

LREIT achieved another year of outstanding results in being recognised as sector leader in the Asia Retail (Listed) category under the 2024 GRESB Real Estate Assessment with the highest-tier rating of 5 Star for its ESG performance and strong leadership in sustainability for five consecutive years since its listing in 2019. In addition to clinching these top accolades as the sector leader, LREIT also scored “A” for Public Disclosure, underscoring its strong commitment to ESG transparency and stakeholder engagement.

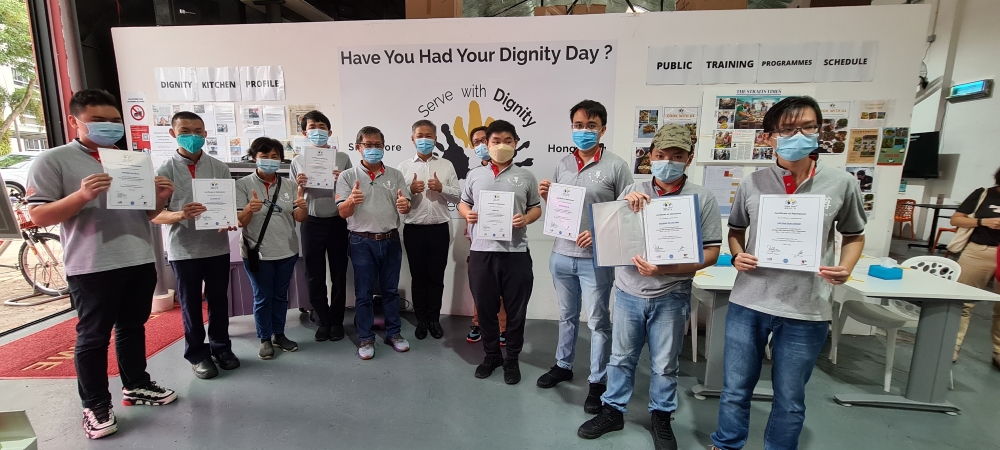

PROJECT DIGNITY

The Manager first engaged with Project Dignity in 2022 as a business champion to support the training of 40 trainees in Dignity Kitchen’s train-and-place programme to equip the differently-abled to have the skills to contribute to the F&B industry.

In the past years, the Manager have collaborated with them to prepare bento lunches for needy families as well as supported Project Dignity Mama’s book donation drive with over 800 books collected.

DISABLED PEOPLE'S ASSOCIATION

The Manager recognises its responsibility to society and is committed to creating value by assisting vulnerable groups and enhancing the lives of all in Singapore. Since 2022, it has partnered with the Disabled People’s Association (“DPA”) to organize a series of activities aimed at raising awareness and demonstrating how everyone can take action in their personal and professional lives to empower individuals with disabilities. Additionally, supported by the Lendlease Foundation, the DPA has developed an Access Guide for Jem mall, a first for a retail space in Singapore. The informative document showcases the accessible features and information for persons with disabilities and their families to plan their visits and navigate the mall.

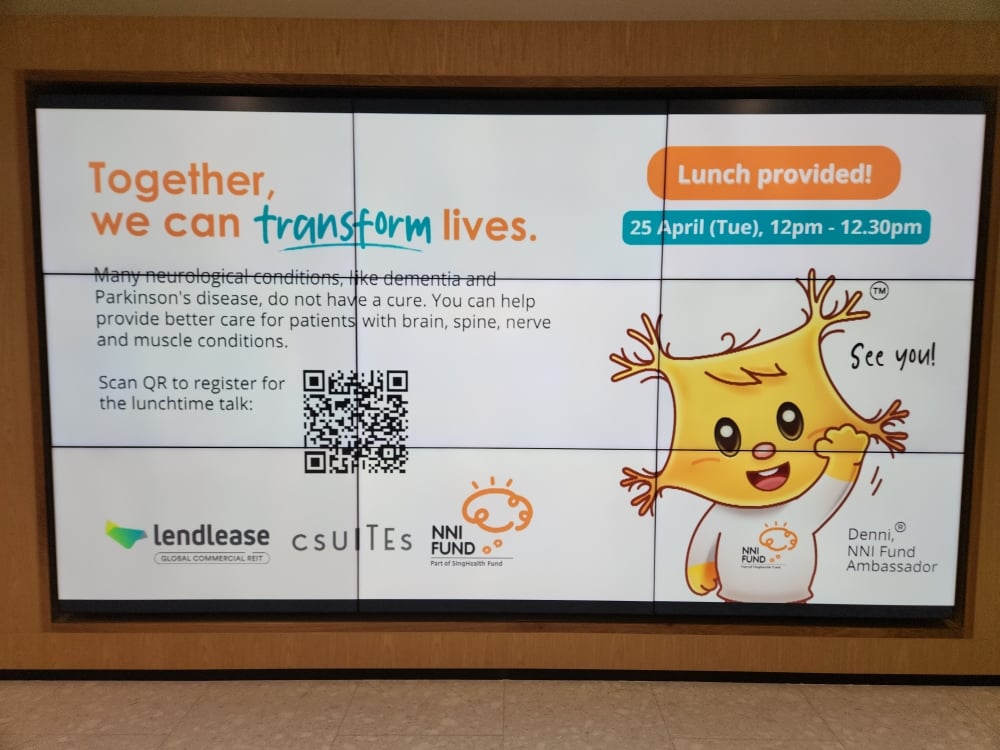

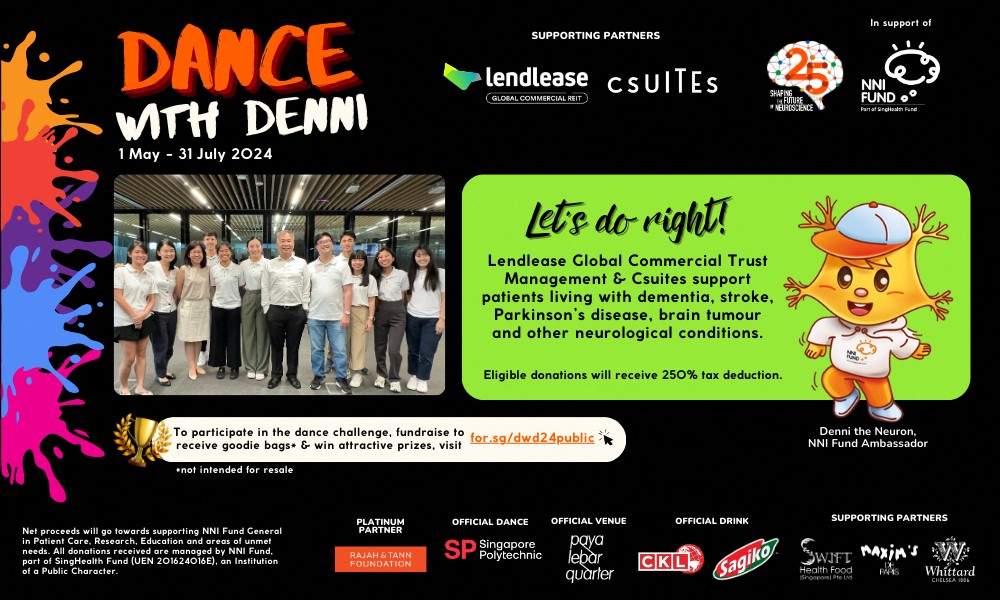

NATIONAL NEUROSCIENCE INSTITUTE (NNI) FUND

The Manager recognises the importance of raising awareness on neuro conditions affecting the brain, spine, nerve and muscle for its employees as well as the broader community. With better health, the vision of creating thriving communities would be closer within reach.

Since 2021, the Manager has partnered the National Neuroscience Institute (“NNI”) Fund to raise awareness on dementia, stroke, Parkinson’s disease and brain tumours among other neurological conditions. Retail tenants across Lendlease-managed malls were also onboard to join the Manager in NNI’s annual fundraising exercise.

LREIT’s approach to sustainability is guided by the Responsible Property Investment Policy of the investment management business and the ESG aspects of the broader Lendlease Group.